Credit Cards

Get the credit you deserve.

Not all credit cards are created equal. That’s why at DuTrac, you can choose from the cards you qualify for based on your credit needs.

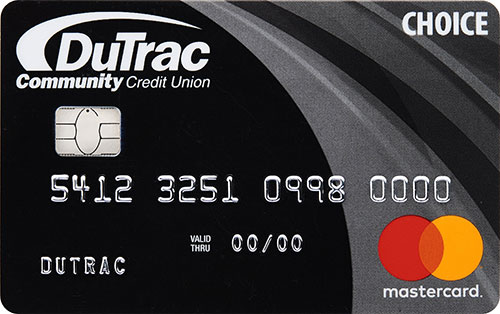

CHOICE Mastercard

Place the power of rate choice in your hands. Choose between a variable or a non-variable rate card.

Learn more at Mastercard Guide to Benefits.

Platinum Rewards Mastercard

The Platinum Reward card is earned by those members with the best credit. On top of a great rate, DuTrac’s Platinum Rewards Mastercard offers the outstanding uChoose Rewards program. Earn points every time you use your card and redeem your points for Cash Back or items.

Learn more at Mastercard Guide to Benefits.

DuTrac Credit Card FAQs

To report a lost or stolen credit card, ATM Card or debit card, call (563) 582-1331.

To report a lost or stolen credit card AFTER REGULAR BUSINESS HOURS call (855) 851-5316.

To report suspicious activity on your account or if you have been a victim of fraud, call (563) 582-1331.

With uChoose Rewards you earn points every time you use your DuTrac Platinum Rewards or Business Platinum Rewards Mastercard – and with some retailers, earn additional points. You will begin earning points on your DuTrac Platinum Rewards or Business Platinum Rewards Mastercard with your first purchase.

To view your points earned and access uChoose Rewards, log in to e-Banking and click on credit cards on the left sidebar. The uChoose Rewards link will be connected through their logo on the lower left-hand side of the page.

It can take up to 30 business days for your points to be credited to your account and you must accumulate one point before you can start redeeming.

Afterward, you can redeem for any number of things by simply looking for “Total Points Available for Redemption” on the “Point Details” page on the uChoose Rewards site to see how many points you have available.

To view your points earned and access uChoose Rewards, log in to e-Banking and click on credit cards on the left sidebar. The uChoose Rewards link will be connected through their logo on the lower left-hand side of the page.

You can then visit the “Redeem Points” page to choose from millions of options whether you prefer products, travel experiences, activities, event tickets, gift cards, make a deposit to a checking account or receive cash back.

Points will expire three years from the end of the month in which they were posted and a maximum of 200,000 points per year can be earned.

If you return or cancel an item, points to your account are reversed from that sale.

If you choose cash back when redeeming your points, cash will be given back in the form of a credit on your Mastercard credit card statement. Minimum amount of 2,500 points is needed to redeem cash back.

Contact Card Services at 563.582.1331 for a balance transfer.

Additional benefits available include:

Our Member’s Choice Payment Protection can help if your income is reduced or eliminated due to involuntary unemployment, a disabling injury or illness or an unexpected death. Click here to begin a Member Protection claim.